The 4% rule ~ This “rule” is used to describe the rate at which money is withdrawn from “retirement” accounts designed to help pay bills when you retire and stop working. The goal is to never run out of money.

It evolved many years ago to include the assumption it would keep you from running out of money before you died. That assumption is no longer as valid as it was. That’s because many of us are living longer than before, the cost of health care is always increasing, and the likelihood of significant market crashes along the way can mess up your plans dramatically.

For the past several decades, I’ve been professionally involved helping others, and myself, focus on realistic and effective retirement planning. A question with implications for every one of us is to try and make sure our money lasts at least as long as we’re alive. If you live to age 85 or beyond, it’s reasonable to assume you’ll still have bills to pay.

So what to do? Whatever you decide, it’s a crap shoot. However, the following thoughts might be helpful.

A few years ago I posted an article on my website about ‘rolling bear markets’ and what they will do to your assumptions about how fast you should withdraw money from your retirement accounts. The only real answer is to start saving earlier, save more and hope for the best. And know that hope is not an effective investment strategy for anyone.

Increasingly, I find myself working with older clients. After all, I’m an older advisor. From time to time I get asked about how fast you should decumulate your nest egg(s). (I’m not sure if “decumulate” is an approved word, but the intent is to convey the opposite of “accumulate”.)

The rule of thumb has been to restrict withdrawals to 4% annually to help insure the money will last until you die. Only no one is willing to tell me when they will die. From my perspective as an advisor, I try to find common ground with a client so that in their mind we have reached a reasonable conclusion. It might be 3% or it might be 6%, leaving the 4% rule somewhere in between.

For many years there have been “experts” who have expressed their opinion about the optimum rate to withdraw money from accumulated retirement funds. The reason is an attempt to offset a fear by most of us about running out of money before we die. Typically, that’s not a good thing.

One of my expressions to increase the understanding of this is to stress that retirement is a transition from working for money to having money work for you. The objective for everyone is to have as big a pile as possible from which to draw funds to pay for the things you need and the things you want.

The dilemma comes full circle when I next ask, “When do you plan to die?” I’ve not yet met anyone who is willing to hazard a guess. So you will likely fall somewhere between running out of money before you die or dying with money in your accounts. If that happens, perhaps you could have spent the last few years in the south of France with side trips to Paris.

Simply put, there is NO best answer, but almost everyone wants to find a “best” answer. My role is to help you find yours.

Unless you’re a financial planner like me, this may put you to sleep. On the other hand, if you are thinking about retirement, or are already retired, and have a nest egg of money ready to work for you, you have to find ways to turn that nest egg into a predictable income. And please understand, this is a very different issue than how your money is invested.

My argument is that for most of your adult life you are working for money and presumably have an income. At some point, this changes and instead of working for money, money has to start working for you and provide your income. This income has probably got to last your lifetime, and that of your spouse, if you have one. Because the chances of you coming into additional money from this point forward are probably slim to none.

If you are between the age of 55 – 75, I encourage you to explore this idea. There is no assurance your financial advisor has a better understanding of this than you do. Unfortunately, if you do run out of money, there’s not a lot of remedies.

All this being said, the 4% rule is a good place to start. It can be revisited in later years, assuming you have later years, and make appropriate adjustments. There exist today new approaches to having money work for you that should be explored and used to minimize the risk of running out of money.

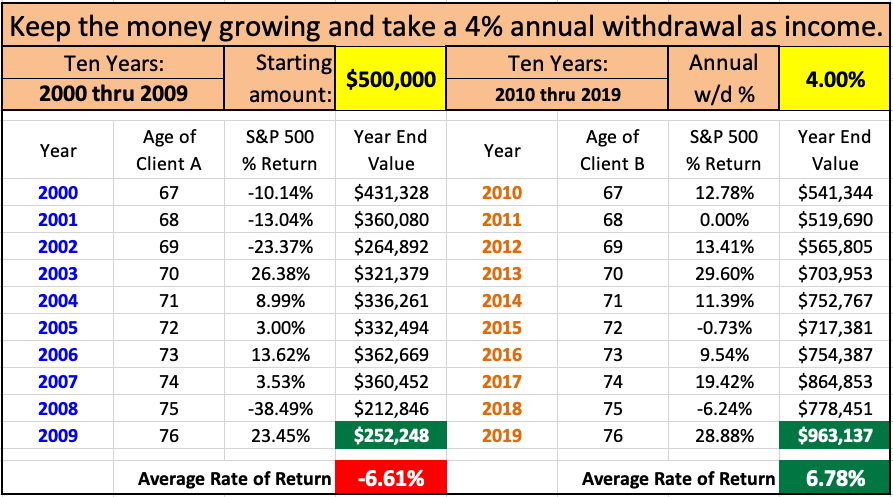

This chart compares two ten-year periods: 2000 thru 2009 and 2010 thru 2019. They show an investment of $500,000 (it could be $100K or any amount you choose).

Both sides show the money invested in the S&P 500 with the 4% rule applied each year. The key to this is to understand what might happen if you transitioned from working to not working in 2000, and instead, be ten years younger and transition in 2010. The amount of money you had left ten years later is dramatically different. Which brings to mind what I said earlier about all this being a crap shoot.

The key numbers for me are how much is left to provide income at the end of the respective ten-year periods. I’ll let you to decide which number you’d prefer.

All anyone can do is try and make an informed decision, mindful there are ways to put that $500,000 to work to minimize the negative outcome if 2000 thru 2009 happens again.

The ultimate goal is to find a way to help you sleep at night with one less thing to worry about. Financial worries will never totally disappear but there are ways to minimize the potential negative outcomes.

Tony Kendzior, CLU, ChFC

Keep this in mind. If you retired on October 9th, 2007…..the day of the ALL TIME HIGH prior to the global financial crisis……and had two years of expenses in a treasury only money market fund, with the rest in an 80/20 pie of globally diversified Vanguard or Dimensional funds…..you’d be fine. Since then, such an investment has annualized at about 5%…which is abysmal, but keep in mind you literally retired on the worst day of the century to retire.

Get a financial planner who uses cheap funds, invests in a diversified pie of cheap ETFs, and reblances. No one should go this alone.

Trying to game this just transfers money from the emotionally weak to the emotionally strong. Own companies, don’t dally in “the stock market.” Understand that paradigm

Imagine walking in to a Walmart, buying batteries, deoderant, a socket wrench, and a bunch of carrots. Then, try and selling them for more than you paid for them. That’s what it’s like trying to time the market and trade stocks. Just buy the Walmart and pick everyone else’s pocket.

LikeLike