My Comments: In my many years on this planet, there have always been financial issues that affect virtually all of us. Today, there’s fear we’re heading toward a recession, there’s an election approaching which has many people concerned, inflation is an issue with too many of us on the lower end of the spectrum dealing with the cost of food, gasoline, insurance and other things.

I don’t have an answer for you and what steps you should take to find some relief. What I do have for you is an argument that suggests that taxes are no longer set up in our best interest as a society. Too many folks at the upper end of the spectrum are not paying their fair share.

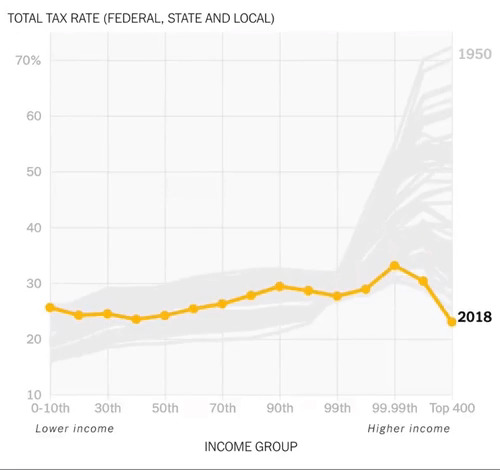

Here is an image from a short video I saved that compares taxes paid by about 60% of the lower income spectrum. Over time those on the right payed significantly tax rates than those on the left. It came from an .MP4 file with a yellow line appearing rapidly with each year that passed. (Email me if you want to see it and I’ll send it to you.) I make no claims to its accuracy but thought it worth sharing as we all come to terms with who we ultimately vote for this fall. The grey background lines show what each element of the income group paid in taxes from 1950 through 2018. I tried to find one that went to 2023 but had no luck.

By Jake Johnson / 3 MAY 2024 / https://tinyurl.com/4k4zmt5x

An analysis published Friday by the renowned economist Gabriel Zucman shows that in 2018, U.S. billionaires paid a lower effective tax rate than working-class Americans for the first time in the nation’s history, a data point that sparked a new flurry of calls for bold levies on the ultra-rich.

Published in The New York Times with the headline “It’s Time to Tax the Billionaires,” Zucman’s analysis notes that billionaires pay so little in taxes relative to their vast fortunes because they “live off their wealth”—mostly in the form of stock holdings—rather than wages and salaries.

Stock gains aren’t currently taxed in the U.S. until the underlying asset is sold, leaving billionaires like Amazon founder Jeff Bezos and Tesla CEO Elon Musk—a pair frequently competing to be the single richest man on the planet—with very little taxable income.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to rustle up around $13 billion in tax-free loans to put toward his acquisition of Twitter.”

To begin reversing the decades-long trend of surging inequality that has weakened democratic institutions and undermined critical programs such as Social Security, Zucman made the case for a minimum tax on billionaires in the U.S. and around the world.

“The idea that billionaires should pay a minimum amount of income tax is not a radical idea,” Zucman wrote Friday. “What is radical is continuing to allow the wealthiest people in the world to pay a smaller percentage in income tax than nearly everybody else. In liberal democracies, a wave of political sentiment is building, focused on rooting out the inequality that corrodes societies. A coordinated minimum tax on the super-rich will not fix capitalism. But it is a necessary first step.”

Responding to those who claim a minimum tax would be impractical because “wealth is difficult to value,” Zucman wrote that “this fear is overblown.”

“According to my research, about 60% of U.S. billionaires’ wealth is in stocks of publicly traded companies,” the economist observed. “The rest is mostly ownership stakes in private businesses, which can be assigned a monetary value by looking at how the market values similar firms.”

Since 2018, the final year examined in Zucman’s analysis, the wealth of global billionaires has continued to explode while worker pay has been largely stagnant. As of last month, there were a record 2,781 billionaires worldwide with combined assets of $14.2 trillion.

The U.S. has more billionaires than any other country, with 813 individuals worth a combined $5.7 trillion.

“The ultra-wealthy are paying less in taxes than the bottom half of income earners. That’s absurd!” Rakeen Mabud, chief economist at the Groundwork Collaborative, wrote in response to Zucman’s analysis. “We’ve got to raise taxes on the wealthy and large corporations. Enough with the wealth hoarding. It’s past time for us to take back what’s ours.”

U.S. Sen. Sheldon Whitehouse (D-R.I.), chair of the Senate Budget Committee, called the figures assembled by Zucman “disgraceful” and said that “not only can we fix this, we can make Social Security and Medicare safe and sound as far as the eye can see.”

It’s always impressive to see how people just don’t understand how things work. Elon Musk will pay more taxes in the next month than all of us combined will in our entire lifetimes, by a multiple factor.

The top tier of tax payers pay most of our taxes. According to most recent numbers from the Tax Foundation, the top 1% of income earners pay 45% of the taxes. The top 10% pay about 75% of the taxes. https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2024/#:~:text=High%2DIncome%20Taxpayers%20Paid%20the%20Majority%20of%20Federal%20Income%20Taxes,of%20all%20federal%20income%20taxes.

Billionaires employ millions of people….and pay their employer payroll taxes. How do you get to be a billionaire? By solving the most problems for the most people. This idiot author is more intent on praying on your emotions and appealing to your envy. How low brow.

Oh, by the way, federal revenues are at an all time high. So let me ask you…is the problem revenue, or is it spending?

Elon borrowing against his assets seems to be an issue with this author. Um….he has to pay those loans back…..and the loaners have to pay taxes on the income.

A little crtical thinking goes a long way.

LikeLike